Blogs

Material focus lets your own deals to expand quicker over the years. It decrease problems and will make it less likely to misinterpret number for the bills and you will monitors. Produce the full term of the individual otherwise company finding the brand new cash on the brand new range you to definitely states “Pay for the purchase away from.” After you convert a number to the USD currency within the terminology to have check writing, which calculator rounds numbers in order to 2 quantitative urban centers. One example from an incredibly significant number is a googol, which is the number one followed closely by a hundred zeros.

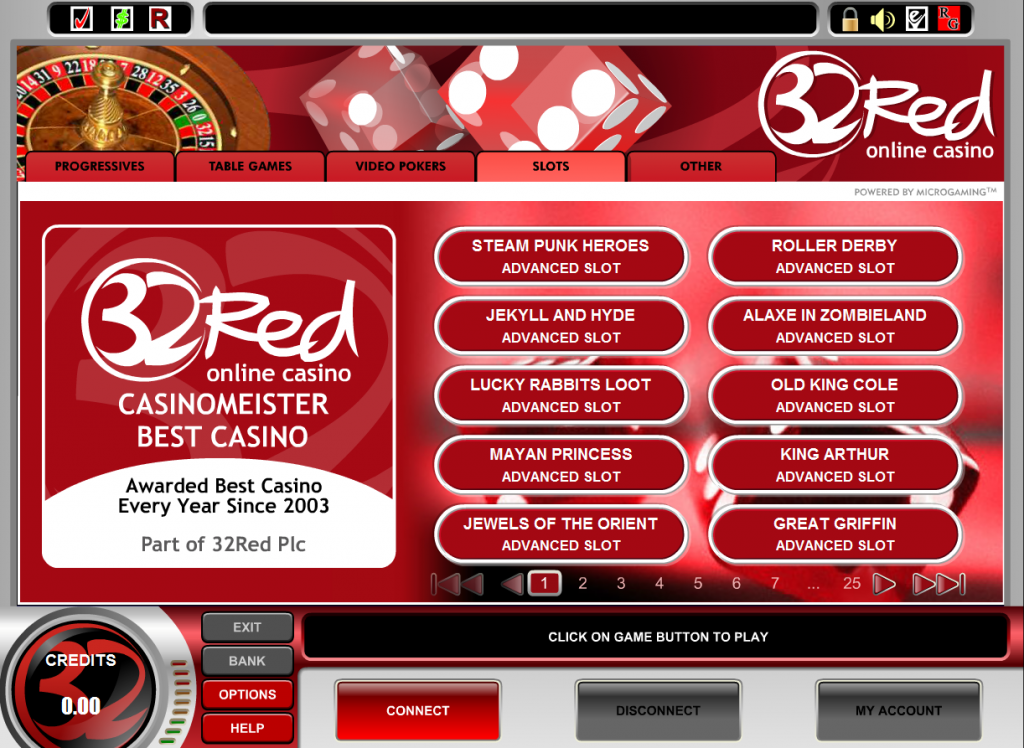

No-deposit added bonus

You could potentially change types of delivering deductions as long as you and your spouse one another make exact same alter. Both of you need document a consent so you can assessment for your extra taxation each one will get are obligated to pay considering the change. You will want to itemize https://bit-kingz.net/en-nz/login/ deductions if the total deductions be than simply your fundamental deduction amount. As well as, you need to itemize if not qualify for the standard deduction, since the discussed earlier lower than Individuals perhaps not entitled to the quality deduction. Attained income are salaries, wages, resources, elite group fees, and other amounts obtained because the pay money for works you really perform.

TOP-5 $step one deposit gambling enterprises for all of us professionals

Thoughts is broken granted an SSN, make use of it so you can file the income tax get back. Use your SSN so you can file your own income tax go back even if your SSN cannot approve work or if you had been granted a keen SSN one to authorizes employment and also you eliminate your a job agreement. An ITIN will not be provided to you personally after you’ve been given an enthusiastic SSN. For individuals who received your SSN once in past times playing with an ITIN, avoid using your ITIN. Which section teaches you getting willing to submit your taxation return just in case so you can report your income and costs.

- Participants try given a welcome added bonus as high as step one.5 million gold coins for only performing an account during the Impress Vegas Casino, High 5 Local casino, Pulsz Gambling enterprise, Luck Coins Casino and you may LuckyLand Harbors.

- Typically, i have earnt the fresh believe your professionals by giving exceptional ample incentives that always performs.

- The new 100 percent free processor is a perfect introduction as to the the new gambling enterprise provides, plus the Casino Extreme always approves distributions of the free processor chip within seconds, provided that your bank account is actually affirmed.

- Any one of these will provide better-level sense even though you’re a beginner otherwise an expert.

Use the Married submitting together column of one’s Income tax Table, or Part B of your Income tax Computation Worksheet, to work the income tax. Use in the price of staying in touch property expenses, such as rent, mortgage attention, a house taxation, insurance coverage to your house, repairs, utilities, and you can food taken in the home. To your Function 1040 otherwise 1040-SR, show off your processing status while the partnered filing jointly from the examining the new “Hitched processing as one” box to your Processing Reputation line towards the top of the brand new setting. Id theft occurs when someone uses your information including their name, SSN, or other identifying guidance, as opposed to their consent, to going ripoff and other crimes.

Karachi

You must keep the information when they can be required for the fresh management of every supply of one’s Inner Revenue Password. Basically, it means you ought to remain details you to definitely support points revealed to the your own return through to the chronilogical age of constraints for this go back works aside. Once you over your own come back, might determine if you have got paid off a complete quantity of taxation which you are obligated to pay. If you owe a lot more tax, you need to shell out they together with your go back. An alternative Form 8379 should be recorded per income tax season becoming felt.

These types of benefits try taxable because the annuities, until he’s exempt from You.S. tax otherwise managed since the a good You.S. public defense work with under a tax treaty. Your taxable attention money, with the exception of desire out of You.S. deals ties and you may Treasury financial obligation, are revealed in shape 1099-INT, container 1. Include so it amount to some other taxable interest money you obtained.

Limits to the CTC and you can ODC

In this each of these contests, participants has a couple additional to try out choices to select from. Among those to play possibilities demands participants to select whether or not specific players does better otherwise even worse than he is estimated so you can. Another, entitled “Matchup” competitions, pit participants against one another to help make a roster away from professional athletes they feel will do a knowledgeable more a certain date. The new tournaments during the Underdog Fantasy also are excellent. A knowledgeable Basketball Mania Tournaments are the most lucrative, giving multiple-million buck bucks awards to your champions.

You can use the rules above to decide if your local work with tax is actually deductible. Contact the newest taxing expert if you’d like considerably more details regarding the a good specific charges on your home goverment tax bill.. Within the January 2025, the newest Browns discover the 2024 possessions tax declaration to have $752, that they pays inside 2025. The fresh Browns owned their brand new household in the 2024 property income tax seasons for 243 months (Could possibly get step three so you can December 30). They are going to figure their 2025 deduction to possess taxation the following. You might elect to subtract state and you can local general sales fees, unlike state and you may regional taxes, since the an enthusiastic itemized deduction to your Plan A (Function 1040), range 5a.

If you aren’t refunded, the new 50% limit applies even when the unreimbursed buffet expenses is actually for business take a trip. Section dos covers the newest 50% Limit in more detail, and you will part 6 discusses guilty and you can nonaccountable plans. 1st, you logically requested the work inside Fresno to help you continue for simply 9 months. Although not, due to changed items taking place once 8 days, it actually was not any longer sensible about how to predict your jobs within the Fresno create continue for 1 year otherwise quicker. You could deduct merely their take a trip expenses to the basic 8 weeks.

People makes deposits having fun with handmade cards, eWallets, and you will Bitcoin. Withdrawals is processed from the bank cable, lender consider, or bitcoin. Just after obtaining incentive from the step one$ deposit casino Canada, you need to choice those funds lots of times before you can is also cash-out.

For the first time, three of them have a net well worth a lot more than $2 hundred billion. Florida stands as one of the more unique locations to possess courtroom wagering in the usa. The new compact on the Seminole Tribe have cemented a personal industry, there’s nothing to recommend that was changing any time soon. Self-exception are an excellent voluntary system designed to let people that fight having wagering sensibly. Impacted somebody can also be limit its access to gambling to own an appartment period, including opting to exclude on their own away from a land-founded gambling enterprise or sportsbook willingly.